Rethinking Measurement and Attribution in B2B Marketing

Measurement and attribution at B2B organizations is a tough subject, not because we don’t have enough data, but because we’re often looking at it the wrong way.

A lot of the time, measurement frameworks are built around the funnel — how many leads did we get, how many turned into MQLs, how many deals closed. While this feels like a logical approach, it doesn’t always align with the broader business goals. It’s a bit like optimizing for miles run when the goal is to win a race. Leads are useful, but they’re not the whole story.

One of the underlying issues is the disconnect between marketing and sales goals. Sales teams are focused on deals, pipeline, and hitting quota. Marketing often gets measured on lead volume or engagement metrics, which don’t always tie back to revenue in a meaningful way. This gap creates friction and makes it hard to have productive conversations about what’s working and what’s not.

A more unifying metric being talked about is marketing-influenced revenue, the idea that marketing has a role to play across the entire buyer journey, not just the top of the funnel. This metric encourages a more holistic view and creates shared accountability between marketing and sales.

The old model of judging marketing purely by the number of leads generated feels increasingly ineffective. It oversimplifies a buyer journey that’s become anything but linear. Fortunately, many B2B firms are recognizing this and evolving how they approach measurement and attribution.

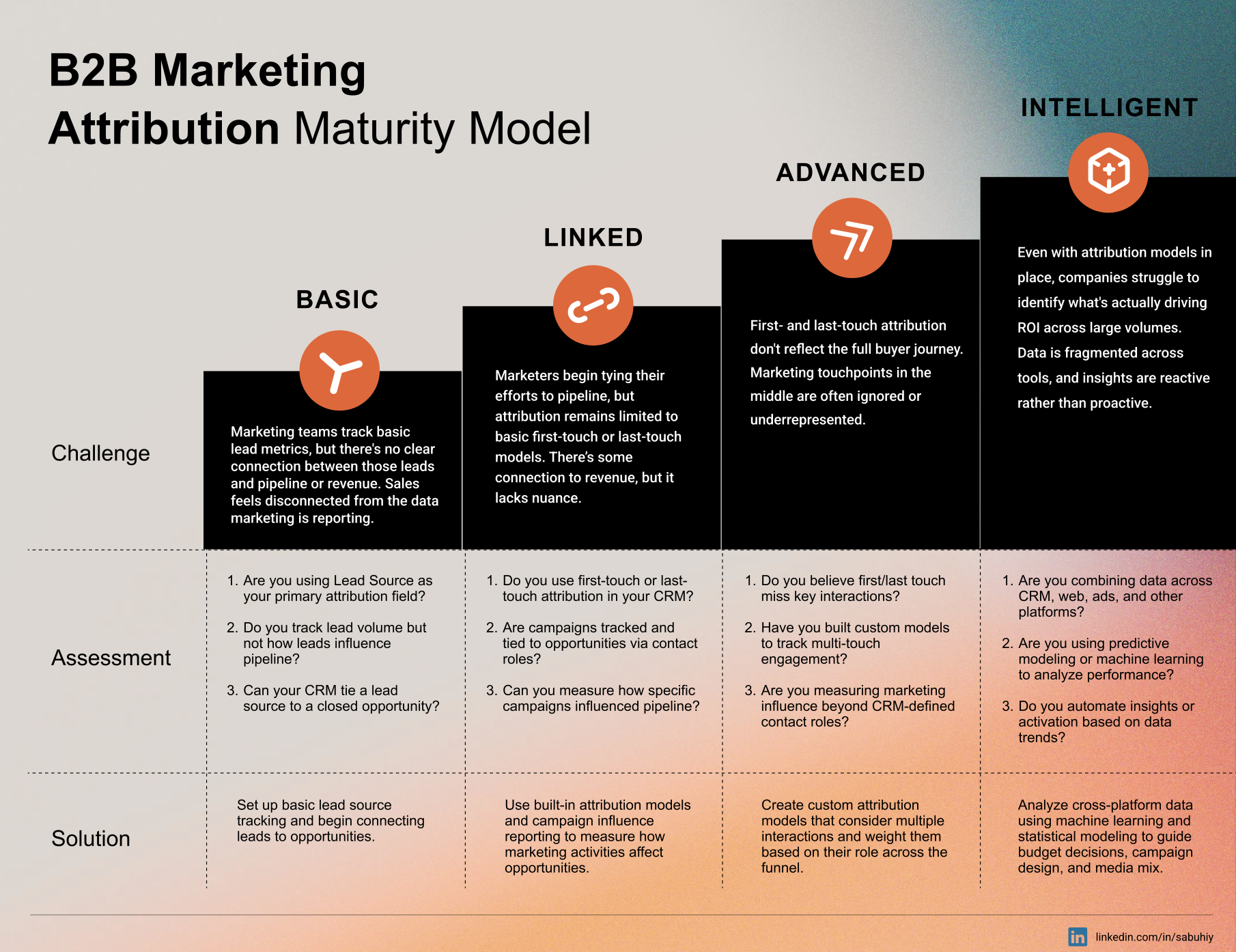

The evolution typically plays out across four stages of measurement maturity:

Stage 1: Basic

Challenge: Marketing teams track basic lead metrics, but there’s no clear connection between those leads and pipeline or revenue. Sales feels disconnected from the data marketing is reporting.

Solution: Set up basic lead source tracking and begin connecting leads to opportunities.

Example: A marketing team using Salesforce tracks whether a lead came from a webinar, paid ad, or trade show. They report on monthly lead volume by source but don’t connect this data to pipeline or closed-won deals.

Questions to ask yourself:

- Are you using Lead Source as your primary attribution field?

- Do you track lead volume but not how leads influence pipeline?

- Can your CRM tie a lead source to a closed opportunity?

Stage 2: Linked

Challenge: Marketers begin tying their efforts to pipeline, but attribution remains limited to basic first-touch or last-touch models. There’s some connection to revenue, but it lacks nuance.

Solution: Use built-in attribution models and campaign influence reporting to measure how marketing activities affect opportunities.

Example: A Salesforce user enables the standard Campaign Influence model, tracking which campaigns were associated with opportunities based on contact roles. They can now report that a recent webinar contributed to 15 opportunities, even if it wasn’t the original lead source.

Questions to ask yourself:

- Do you use first-touch or last-touch attribution in your CRM?

- Are campaigns tracked and tied to opportunities via contact roles?

- Can you measure how specific campaigns influenced pipeline?

Stage 3: Advanced

Challenge: First- and last-touch attribution don’t reflect the full buyer journey. Marketing touchpoints in the middle are often ignored or underrepresented.

Solution: Create custom attribution models that consider multiple interactions and weight them based on their role across the funnel. Look beyond contact roles to account for anonymous or indirect engagement.

Example: A company builds a custom attribution model that assigns different weights to early-stage awareness (e.g., content downloads), mid-funnel activities (e.g., product webinars), and late-stage interactions (e.g., sales enablement events). They use this model to evaluate the entire journey of deals and optimize future campaigns.

Questions to ask yourself:

- Do you believe first/last touch miss key interactions?

- Have you built custom models to track multi-touch engagement?

- Are you measuring marketing influence beyond CRM-defined contact roles?

Stage 4: Intelligent

Challenge: Even with attribution models in place, companies struggle to identify what’s actually driving ROI across large volumes. Data is fragmented across tools, and insights are reactive rather than proactive.

Solution: Analyze cross-platform data using machine learning and statistical modeling to guide budget decisions, campaign design, and media mix.

Example: A company combines CRM, web analytics, ad platform, and third-party data into a data warehouse. Their analytics team runs regression-based analysis to determine which channels drive the highest ROI. They use these insights to fine-tune their paid media spend and feed conversion signals back into ad platforms via APIs.

Questions to ask yourself:

- Are you combining data across CRM, web, ads, and other platforms?

- Are you using predictive modeling or machine learning to analyze performance?

- Do you automate insights or activation based on data trends?

This progression isn’t about specific tools, it’s about how data is used to make better decisions. Whether you’re just getting started with lead source tracking or you’re deploying predictive models across multiple systems, the goal is the same: create a measurement framework that helps marketing and sales move in the same direction.

If you’re ready to move beyond leads and build a measurement model that truly reflects growth, connect with us. Our experts are can help you turn data into clarity.